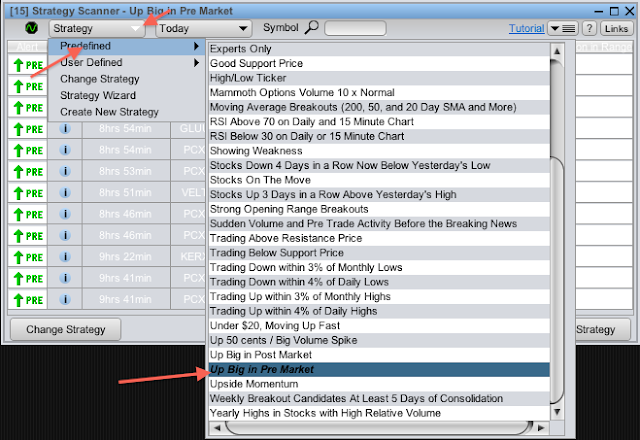

Okay, let's get into how to use Etrade scan for premarket gapper. The scanner on Etrade calls "Strategy Scanner". You can open as many scanner as you like but for my 'gapper scan' we will use 2 of them, 1 for gap down and 1 for gap up. You can also use 'Predefined Strategy' that Etrade already have but that's only for gap up and I don't know the value of the filters they used, that's why I prefer to use my own scanner. Below is a picture of Predefined Strategy. Note: It said "Up Big in Pre Market"

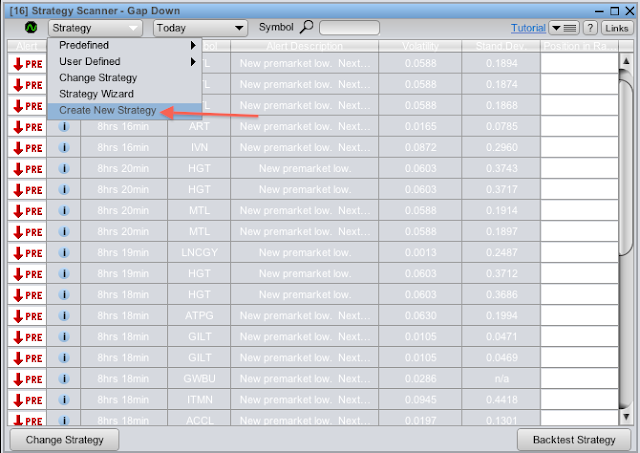

Here is my setting for a 'gap up scan'

Click the arrow to the right of 'Strategy' and select 'create new strategy'.

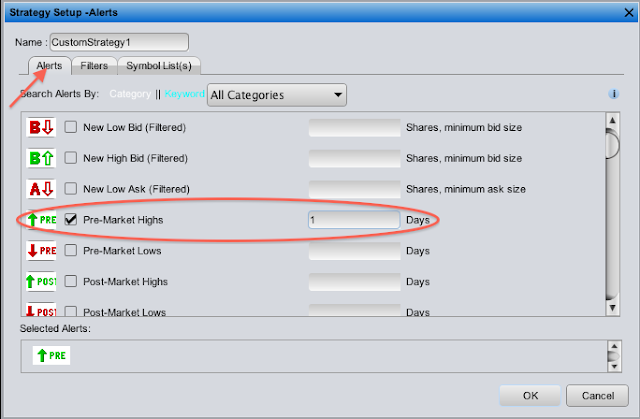

On the first menu 'Alerts' check Pre-Market Highs with value of "1"

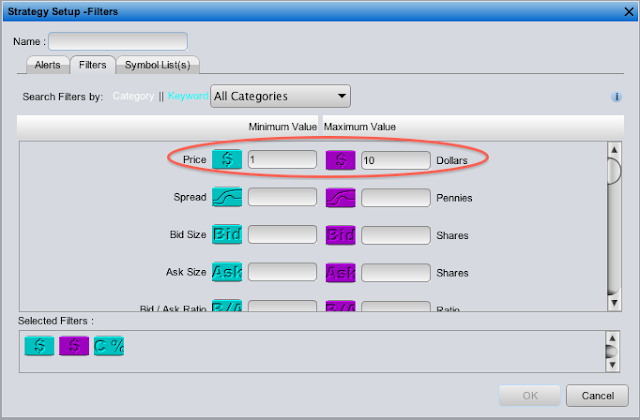

On the second menu 'Filters' fill the price range that you would like to scan. For me, I only play the $1-$10 stocks so mine is going to be 1 and 10 like so. PS. Suggested value $1-$30 (It is easier to borrow shares from higher price stocks, if it is a short scenario).

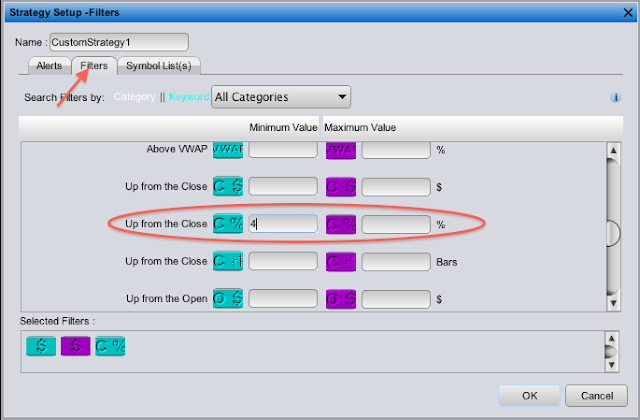

Then scroll down and find C% symbol. This is the value that you going to put 'how many percentage it's up on premarket. I like mine at 3%-4%, if the value is too small then you are going to get a lot of stocks on your scan. Fill the left box with your value and leave the right box empty.

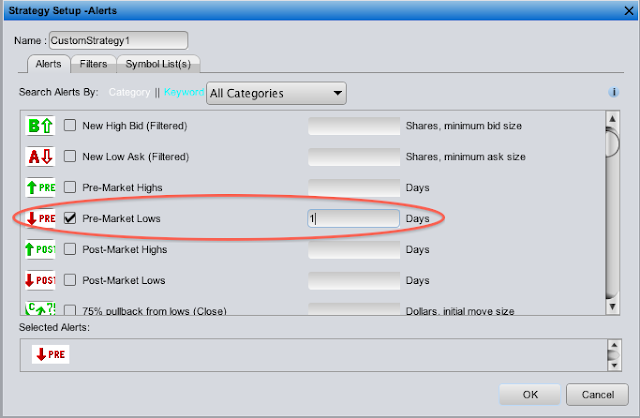

For the gap down scan, just repeat the same step but change the 'alerts' to Pre-Market Lows like so.

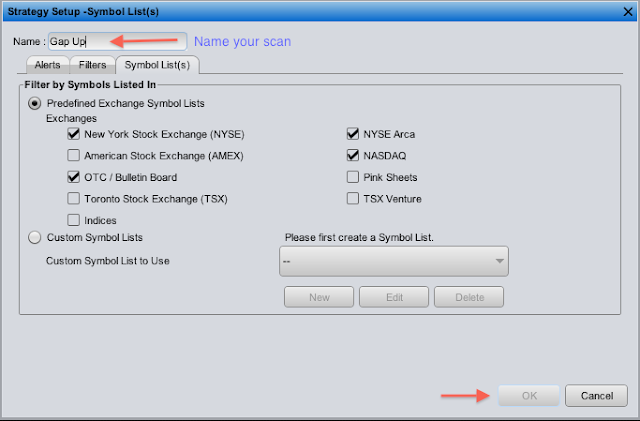

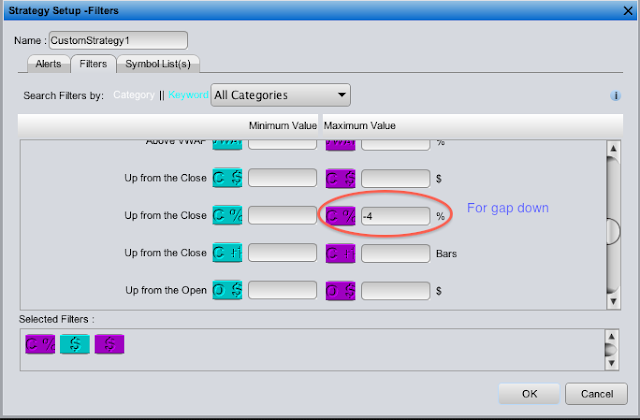

For the 'filters' menu, price range would be the same $1-$10 (for me), BUT on the C% you need to fill negative value on the right box (leave the left one blank). For me is '-4' which means any stock that shows on my scanner must be trading below -4% in premarket. Then go on to 'symbol list(s) menu and check exchange that you want it to scan, NASDAQ, NYSE and etc. Name your scan and click ok.

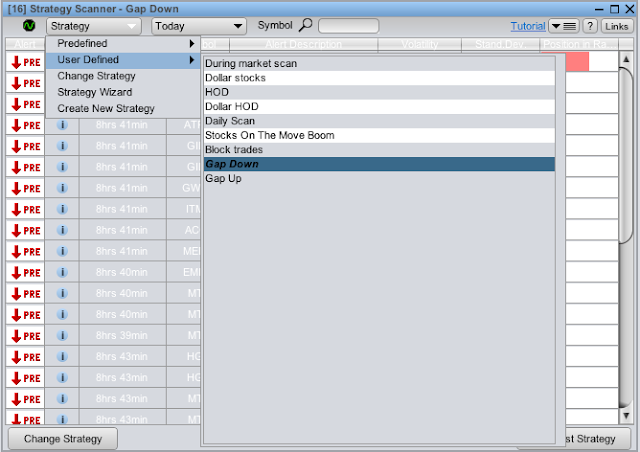

So now when you open your scanner on EtradePro you can just go to 'user defined' and you will see all your scan settings in there.

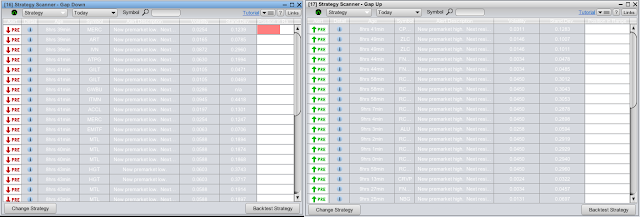

You can put those 2 scans next to each other and there you have 'gap down' and 'gap up' scan, then you can apply Luke's gap play strategy to that = $$$$

PS. Another trick I found which very useful is that when you pull up the charts from gapper scan.On the Daily Chart, look for for ones that have big range in trading history, they have higher chance of making big moves (Also there are many things to consider such as market cap, floats, news and etc but this is just an idea in general). So I would play those over the ones that have less trading range. Also try to get familiar with tickers because the same ticker that moved big on a gap tends to move big again on the next gap. Same rules apply for former runners.

There you have it folks. Remember, with great power comes great responsibilities! Enjoy your evening and see you in chat tomorrow. Peace!